Aviation 3.0

“In the design of an aircraft there is never a right answer - only a best answer at a point in time.” - Leland M. Nicolai / Grant E. Carichner

In a NOVA special last year, Great Electric Airplane Race, viewers are introduced to a new coining of aeronautical eras:

- Aviation 1.0: Started with powered, heavier-than-air flight in 1903

- Aviation 2.0: Started with the jet age of the 1940’s and 50’s

- Aviation 3.0: To start with service of all-electric-powered transport aircraft (ETA: 2020s?)

It’s fair to assess that Aviation 3.0 has not arrived yet1. But this may change before the midpoint of this decade. More than 150 companies around the world are currently in a race to enter the new electric-vertical-takeoff-and-landing (eVTOL) service market, and the US Air Force has already awarded airworthiness approval to the vehicles of four companies: Joby Aviation, Beta Technologies, Lift Aircraft, and Kitty Hawk2. However, the arrival of this futuristic carriage won’t be christened in the U.S. before a successful vehicle certification per an FAA G1 certification basis.

The existence of a vehicle certification path for eVTOL is an epochal shift itself. Years of speculation and debate over anticipated regulatory constraints had added uncertainty to the design and concept-of-operations (CONOPS) of these novel aircraft. While some uncertainty persists, the FAA’s current path-forward for eVTOL manufacturers serves as a regulatory acknowledgment to the promise of electric aviation, and builds an anticipation for commercial services from this sprouting industry.

At the center of Aviation 3.0 lies an increasingly popular concept: Advanced Air Mobility (AAM). NASA broadly defines AAM to be the emerging segment of aviation addressing under-served air transportation markets. In layman’s terms, AAM covers urban/suburban/rural travel services, increased private aircraft ownership, and short/medium-range cargo transportation. All this to say that electric aviation could efficiently support intra-city traffic and regional hops. Much ongoing research into novel techniques for air-traffic control, safety, and collaboration to support this new dimension of mobility continues at NASA Ames today.

So will a Jetsons-inspired utopia come to fruition? Let’s delve into some of the necessary ingredients: funding, vehicle design, battery technology, and infrastructure.

Funding

Per Pitchbook, $3.8 billion was invested into the eVTOL industry over the period of Q1 2021 alone. At this time, four companies have valuations of at least a billion dollars3,4:

- Joby Aviation: $4.4 Billion

- Lilium: $1.9 Billion

- Archer Aviation: $1.4 Billion

- Vertical Aerospace: $1.4 Billion

Funding for electric aviation is presently dominated by private equity, but public and government investments are posed to ramp up. Additionally, NASA’s research into their distributed electric propulsion systems on the X-57 Maxwell paired with their work on Advanced Air Mobility augments support for the electric aviation industry.

Money, support, and resources for scaling eVTOL are currently in abundance, so let’s move on.

Vehicle Design

The challenge of developing eVTOL may be appreciated by first studying the aircraft flying around us. The average jetliner, trusted to handle the bulk of today’s air transportation demand, commonly takes the shape of a wing-and-tube airframe with two high-bypass, underwing-mounted engines. For shorter trips requiring smaller payloads, modest fixed-wing aircraft with piston-powered propellers may be called to service. But for versatile missions necessitating vertical-takeoff-and-landing (or even short-takeoff-and-landing) capability, helicopters are typically the only available option. Like its fixed-wing counterparts, most passenger-carrying rotorcraft utilize a jet turbine.

But take away the kerosene and gasoline, and we are reverted a tough set of requirements and a drawing board. How do you design an electric-powered, passenger-carrying aircraft to takeoff and land like a helicopter, and transition through an efficient forward-flight phase so that meaningful speed and range are achieved?

This was the conundrum that a small group of capable engineers began to ponder over a decade ago…

Larry Page began pursuing a keen interest into flying cars in 2009. He hosted secretive meetings with a knowledgeable inner circle which included: Ilan Kroo (Professor of Aeronautics and Astronautics at Stanford), Mark Moore (Research Engineer at NASA), and Sebastian Thrun (Co-founder of Google’s Waymo). The cohort sensed that an inflection point had been reached; electric motor and battery technology was trending up, and newly conceived aircraft configurations were capable of taking advantage of them. Earnest efforts to develop an air taxi began in 2010 with Kroo at the helm, and Page discreetly backing the company that came to be known as Zee Aero. In the subsequent years, Northern California would become a hotbed of air taxi development as a new wave of companies began spawning, off-shooting, and competing within close proximity.

…With a decade of design iterations now behind us, familiar patterns of eVTOL design are emerging from all corners of the world today. This can be explained by the global pursuit of the same mission: an entry eVTOL vehicle to start competing within the general aviation market, an ability to promptly carry a handful of passengers over large urban environments, and to do so without the aid of a fossil fuel.

The most distinct trademark of eVTOL design is the integration of multiple rotors into the vehicle body and wing. The advent of this new trend, referred to as distributed electric propulsion, disrupts the well-established conventions of aircraft design. Bulky, heavy, and mechanically complex combustion engines can not be distributed about an aircraft the way electric motors can. The distribution of rotors (also known as propulsors) opens a new facet of design possibilities, which can boost flight performance while boasting propulsive redundancy. Factors such as rotor placement, rotor speed, rotor spacing, number of rotor blades, length of blades, rotor-wing interactions, and variable rotor-motor orientation combine to create a complicated design trade-off space. The merit to an optimized integration of propulsors is an unprecedented improvement to aerodynamic efficiency.

As implied within their name, an eVTOL design will start and end each flight with energy-intensive phases of vertical-translation and hover. The all-electric aspect of such a vehicle is certainly challenging, but VTOL capability has precedence among fixed-wing aircraft. In the 1970’s, the U.S. and U.K. jointly developed the AV-8B Harrier II, a ground-attack jet with thrust-vectoring to allow for VTOL capability. The Harrier has now been largely replaced by the F-35B Lightning II, which achieves superior VTOL performance using both thrust-vectoring and a lift fan. But the most relevant aircraft to the eVTOL industry is undoubtedly the V-22 Osprey, the first modern tilt-rotor aircraft to successfully blend VTOL capability with high performance cruise. The Osprey originated from a 1970’s prototype known as the Bell XV-15 Tilt Rotor Research Aircraft. The XV-15 was a revolutionary aircraft which tilted the entirety of its engines and rotors while in flight. The abundance of research conducted on the XV-15 from prior decades serves as a useful foundation for manufacturers today.

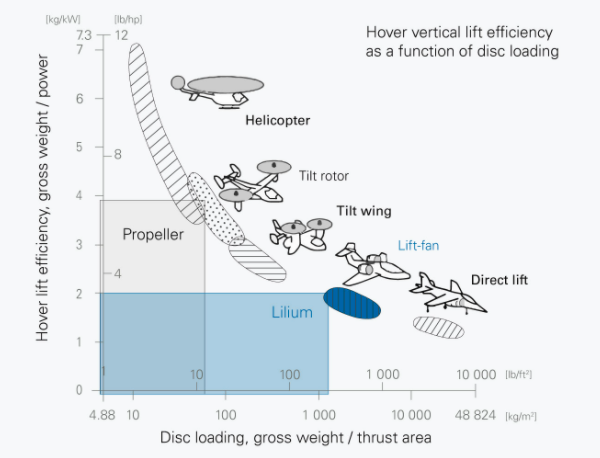

Most leading eVTOL manufacturers have opted for a tilt-rotor configuration to balance the demands of both hover and forward flight. Lilium has taken to the approach of a lift fan configuration; they admit to their lower hover efficiency while citing an artifact from NASA’s XV-15 research, but also remain confident that such losses will be made up for in other aspects. The designs of today’s novel aircraft are in a new, unknown frontier, and it will be exciting to watch how the various approaches will play out in the future.

Battery Technology

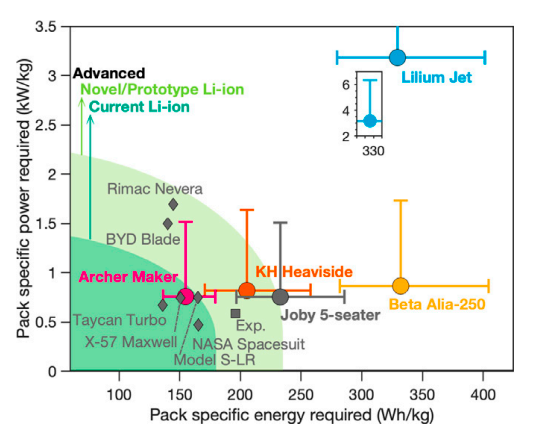

Most of the 2010’s were dominated by the promise of new lithium-ion battery chemistries posed to deliver an energy density of 400 watt-hours-per-kilogram (Wh/kg). For eVTOL, 400 is widely considered the magic number to enable a Cambrian explosion of electric vehicles. Compared to gasoline’s energy density of more than 12,000 Wh/kg, 400 seems downright minuscule. However, electrical systems can boast efficiencies of around 90%, while traditional thermodynamic engines rarely reach an efficiency of 20%. Thus, an efficient and well-designed eVTOL aircraft could begin to effectively penetrate the air transportation market’s lowest tiers with 400 Wh/kg batteries. Production-proven battery packs used in electric automobiles currently top out at a cellular density of 260 Wh/kg.

The electric automotive market has recently started a shift to Lithium-Iron-Phosphate (LFP) batteries with a cellular energy density of 250 Wh/kg. The still incumbent Nickel-Cobalt-Aluminum (NCA) batteries used in electric vehicles remain viable with a slightly better energy density than that of LFP, but are drastically more expensive due to the foreign supply chain of rare-Earth metals. While prone to the same supply vulnerabilities, Nickel-Manganese-Cobalt (NMC) batteries are ubiquitous throughout the electronics market. Much fanfare surrounded the next generation of NMC batteries, which were promised to deliver 400 Wh/kg within the previous decade; the promise of NMC 2.0 has yet to be realized, but significant ongoing research into this battery, as well as countless more chemistries, continues within laboratory settings today.

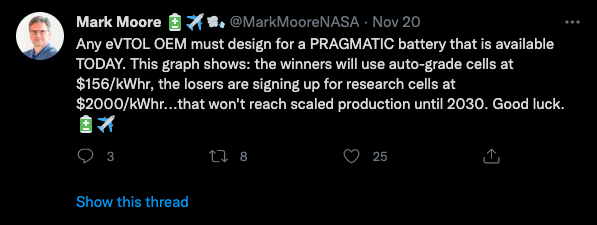

A recent battery report out of Carnegie Mellon analyzed the technological readiness of eVTOL today. A fascinating graph (above) from the report shows the energy and power requirements of a handful of eVTOL aircraft against the backdrop of current battery capability. Mark Moore, an industry insider and advisor to Archer, minced no words when sharing his perspective on COTS batteries.

Infrastructure

In 2016, Uber Elevate was founded to predict and facilitate the ecosystem of eVTOL transportation. With OEM partnerships, Uber secured a prime position to investigate and understand the nuances of what the nascent market may look like in the future. In late 2019, Joby Aviation acquired Uber Elevate, and agreed to an early partnership with Uber’s current ridesharing business. It is to be expected (at least initially) that each competing eVTOL OEM will pursue an independent, proprietary transportation network when the time comes.

The futuristic picture of eVTOL ridesharing painted by the industry players are truly reminiscent of the Jetsons. Sparkling skyports set at the tops of skyscrapers guide passengers - phone in hand - to a red carpet leading to a hushed aircraft ready to takeoff at one’s convenience. The depicted CONOPS are a lure to the future. The prospect of hailing an air taxi by way of rooftop will surely be critiqued and investigated by regulatory authorities for years to come. But the industry has not gotten to that stage yet. Certified eVTOL vehicles, and quantifiable passenger demand are prerequisites to the foundation of eVTOL infrastructure.

It is far more likely that local airports and makeshift airfields on the outskirts of town will be a proving ground for eVTOL when the time comes. But with so much emphasis on low-noise and redundancy requirements today, we know that the final destination for eVTOL will be within the hearts of urban environments.

Tempered Optimism

It is important to stay aware of the inevitable highs and lows any emerging market must toil through. eVTOL is a particularly ambitious effort that requires multiple breakthroughs: novel aircraft, rigorous safety standards, integrated infrastructure, profuse up-front capital, new regulatory oversight and willing passengers.

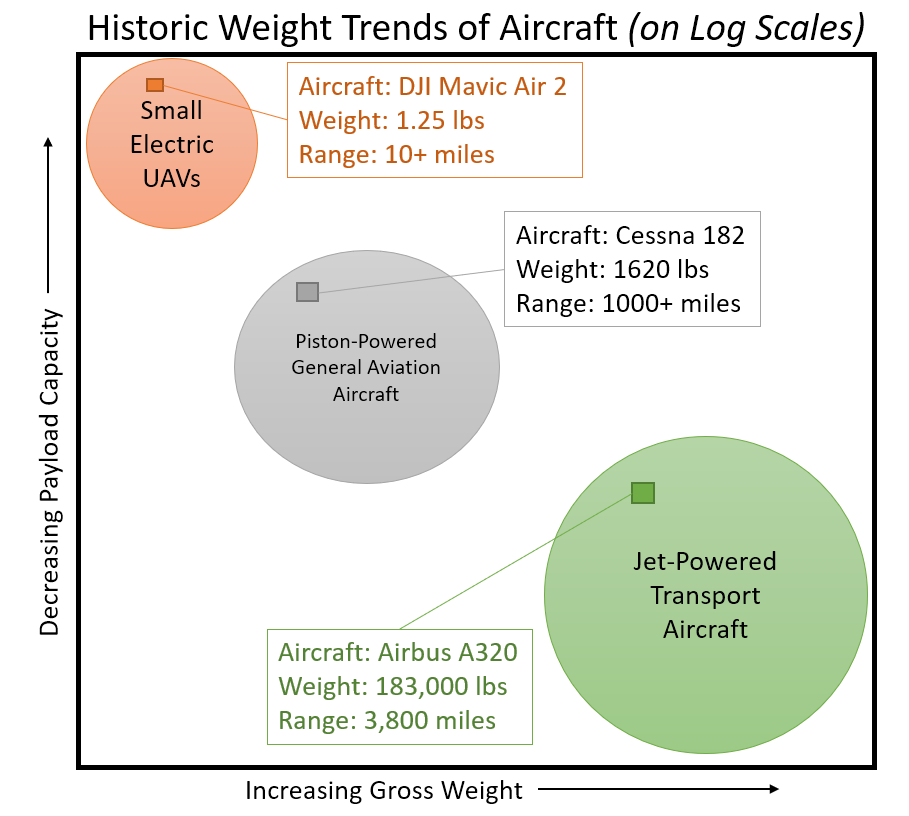

And in the grand scheme of things, the entire eVTOL effort is just the initial stepping stone to electric aviation. As it stands today, an electric airliner is a total fantasy to even the most ardent eVTOL insiders. The figure below demonstrates the disparities between the current classes of aircraft. The eVTOL breakthrough would be represented by a jump from the bottom edge of the orange circle, to the top edge of the gray circle.

This prospective jump may not seem very inspiring, especially considering the log scales of the plot, but would affirmatively kick start the new age of Aviation 3.0. Despite the challenges outlined, I’m optimistic that it’s only a matter of time - either this decade or the next - until electric air taxis turn mainstream.

Footnotes

-

Technically, the Pipistrel Alpha Electro could be construed as the true dawn of Aviation 3.0. It’s a two-seat, all-electric, light sport trainer certified by EASA and FAA. With a max endurance (with reserve) of only 60 minutes, the concept-of-operations is not much more than local flight training.

-

A military airworthiness approval is not as groundbreaking as it may sound. The certification standards of regulatory agencies such as EASA and FAA are far more rigorous and rigid.

-

Valuations of startups - including the ones to have gone public via Special-Purpose Acquisition Companies (SPACs) - are tricky and fickle. Don’t read into them too much.

-

These eVTOL companies quoted are in the capital-intensive business of on-demand, urban flights. Companies focused on other market segments (e.g. cargo transportation) require less capital, and consequently boast lower valuations.